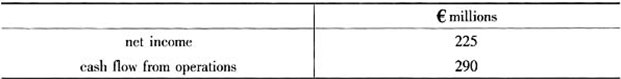

A European based company follows IFRS (International Financial Reporting Standards) and capitalizes new product development costs. During 2009 they spent €25 million on new product development and reported an amortization expense related to a prior year’s new product development of €10 million. Other information related to 2009 is as follows:

An analyst would like to compare the European company to a similar U. S. based company and has decided to adjust their financial statements to U.S. GAAP. Under U. S. GAAP, and ignoring tax effects, the cash flow from operations (€ million) for the company would be closest to:()

An analyst would like to compare the European company to a similar U. S. based company and has decided to adjust their financial statements to U.S. GAAP. Under U. S. GAAP, and ignoring tax effects, the cash flow from operations (€ million) for the company would be closest to:()

A. 265.

B. 275.

C. 290.

参考答案:A

解析:

[分析]: 如果对所有产品开发成本均进行了资本化处理,则应当从净收益中扣除相关费用,并加上之前资本化费用的摊销金额。相应地,营业现金流将扣除当年的产品开发费用,即营业现金流=290000000-25000000=265000000美元。需要注意的是,由于之前的产品开发成本的摊销金额属于非现金支出,从而不会对现金流产生影响。因此,本题的正确选项为A。 [考点] 成本资本化的影响;无形资产成本的资本化