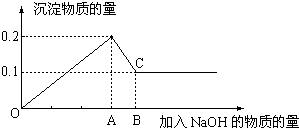

在MgCl2和AlCl3的混和溶液中,逐滴加入NaOH溶液直至过量,经测定,加入NaOH的物质的量和所得沉淀的物质的量的关系如图所示,则:

(1)图中C点表示当加入______molNaOH时,Al3+的存在形式是______(写化学式)

(2)图中线段OA:AB=______.

根据图象可知,在滴加NaOH溶液到加入氢氧化钠为Amol时,沉淀量最大为0.2mol,说明氯化铝、氯化镁恰好完全反应,此时溶液为氯化钠溶液.继续滴加氢氧化钠,但在加入(B-A)mol时,沉淀物质的量最小为0.1mol,是氢氧化镁沉淀,所以加入Amol氢氧化钠是沉淀中有氢氧化镁0.1mol、氢氧化铝0.1mol;此时溶液为氯化钠、偏铝酸钠溶液.

(1)根据氢氧根守恒可知,沉淀量最大时加入的氢氧化钠n(NaOH)=2n[Mg(OH)2]+3n[Al(OH)3]=2×0.1mol+3×0.1mol=0.5mol,C点氢氧化铝完全溶解,根据铝元素、钠元素守恒可知n(NaAlO2)=n[Al(OH)3]=0.1mol,所以溶解氢氧化铝加入的氢氧化钠为0.1mol.所以加入的氢氧化钠的物质的量为0.5mol+0.1mol=0.6mol;C点氢氧化铝完全溶解,铝元素在溶液中以AlO2-存在.

故答案为:0.6;AlO2-.

(2)OA表示滴加NaOH溶液是镁离子、铝离子完全沉淀是需要的氢氧化钠的物质的量,沉淀量最大时加入的氢氧化钠n(NaOH)=2n[Mg(OH)2]+3n[Al(OH)3]=2×0.1mol+3×0.1mol=0.5mol;AB表示溶解0.1mol氢氧化铝消耗的氢氧化钠的物质的量n(NaOH)=n[Al(OH)3]=0.1mol,所以线段OA:AB=0.5mol:0.1mol=5:1.

故答案为:5:1.