问题

选择题

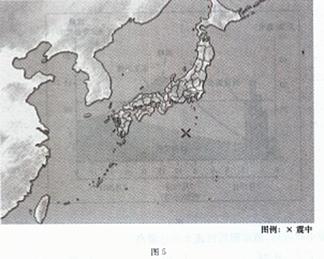

日本气象厅消息,北京时间2012年1月1日13时28分,日本海域发生7.0级地震,震源深度370公里。读图5回答问题。

小题1:当日本发生地震时,下列现象可能发生:

A.北印度洋洋流顺时针运动

B.全球小部分地区进入了2012年

C.此日过后大连昼变长,夜变短

D.华北地区正在收割小麦小题2:关于此次地震的成因及能量来源,的叙述正确的是:

A.因为日本处于太平洋板块和亚欧板块张裂带,地壳活跃,多火山地震

B.来自地壳圈层的能量

C.来自地核圈层的能量

D.来自地幔圈层的能量

答案

小题1:C

小题2:D

本题考查地震和板块运动。

小题1:材料反映日本发生地震时为1月,北半球的冬季,故北印度洋受东北季风影响,形成逆时针的大洋环流;北京时间1日13时28分,即东十二区时间为1日17时28分,故全球有18个时区进入新年;此日后太阳直射点向北移,故北半球昼变长,夜变短。

小题2:日本多地震主要由于日本位于亚欧板块与太平洋板块的碰撞边界,地壳运动活跃,故多火山地震;地震的震源深度370KM,判断震源位于地幔层。