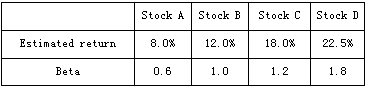

An analyst gathers the following information about four stocks.

The analyst estimates that the risk-flee rate is 5%, and the return on the market portfolio is 12%. Based on the above inputs and the capital asset pricing model (CAPM) , which of the following statements about the valuation of the four stocks is most accurate Stock A Stock B Stock C Stock D()

A. Undervalued Overvalued Properly valued Undervalued

B. Undervalued Properly valued Overvalued Overvalued

C. Overvalued Properly valued Undervalued Undervalued

参考答案:C

解析:

According to the SML equation, the following expected (required) rates of return for these four stocks are :

RA=0.05+0.6×(0.12-0.05)=0.092 or 9.2%

RB=0.05+1.0×(0.12-0.05)=0.120 or 12.0%

RC=0.05+1.2×(0.12-0.05)=0.134 or 13.4%

RD=0.05+1.8×(0.12-0.05)=0.176 or 17.6%

| Stock

|