The following table contains ratios for 2005 and 2006 for Benrttd Company: 20052006 EBIT margin (EBIT/revenue) 0.150.10 Asset turnover (revenue/assets)1.001.50 Leverage ratio (assets/equity) 2.002.50 Tax burden (net income/EBT) 0.700.70 Interest burden (EBT/EBIT) 0.950.95 Which of the following statements about Benrud Company’s return on equity (ROE) is most accurate ROE:()

A. decreased, because the company’s profit margin fell.

B. increased, due to the increase in turnover and leverage.

C. increased, because the company’ s asset turnover increased.

参考答案:B

解析:

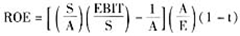

ROE 2005=0.70×0.95×0.15×1.00×2.00=0.1995 or 19.95% ROE 2006=0.70×0.95×0.10×1.50×2.50=0.2494 or 24.94% The profit margin decreased, but asset turnover and leverage increased. Therefore, the company’s ROE increased.

ROE 2005=0.70×0.95×0.15×1.00×2.00=0.1995 or 19.95% ROE 2006=0.70×0.95×0.10×1.50×2.50=0.2494 or 24.94% The profit margin decreased, but asset turnover and leverage increased. Therefore, the company’s ROE increased.