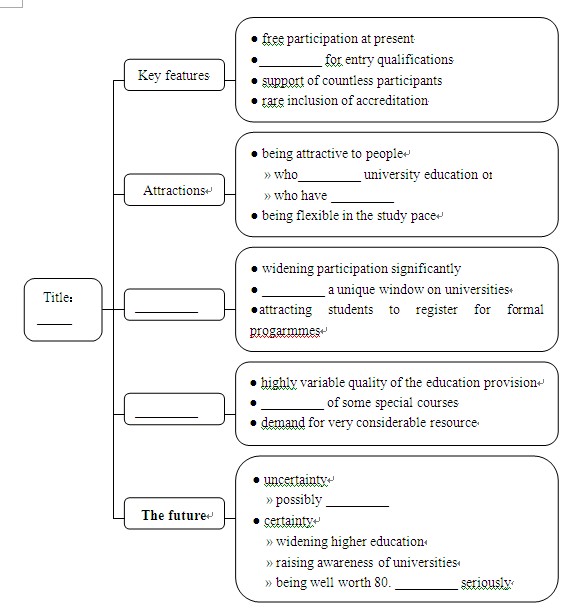

While there is no widely accepted definition of MOOCs, their key features are open access:they are currently free to participants, no entry qualifications are required, they support an unlimited number of participants and as yet, very few include any form of accreditation (认证).

Currently offered by some famous universities, MOOCs are attractive to people who do not have the financial resources to meet the growing costs of university education, or who do not have formal qualifications. They also allow participants to study at their own pace.

The potential for MOOCs to deliver education is obviously vast—they could be considered as a huge step forwards in widening participation. They also have the potential to provide a unique window on universities that offer popular and valuable courses, they may attract some participants to register for formal fee-paying programmes at the same or other universities and are likely to promote new ways of on-line education.

However, it is still very early days for MOOCs. The quality of the education provision is highly variable, with many courses offering only recordings of lectures, and delivery is particularly difficult in some special fields that require practical classes, research projects or extensive library access. Besides, wider engagement with participants requires very considerable resource. Even limited feedback or examination becomes a major task if there are several thousand students in the class.

Considering the challenges, some people argue MOOCs will soon evaporate (蒸发). But they certainly provide good opportunity for widening higher education, are a means of raising awareness of universities to audiences of tens or hundreds of thousands, and are well worthy of serious consideration. (271 words)