回答下列小麦杂交育种的问题:

(1)设小麦的高产与低产受一对等位基因控制,基因型AA为高产,Aa为中产,aa为低产。抗锈病与不抗锈病受另一对等位基因控制(用B、b表示),只要有一个B基因就表现为抗病。这两对等位基因的遗传遵循自由组合定律。现有高产不抗锈病与地产抗锈病两个纯种品系杂交产生F1,F1自交得F2。

①.F2的表现型有_____种,其中能稳定遗传的高产抗锈病个体的基因型为______,占F2的比例为_____。

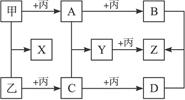

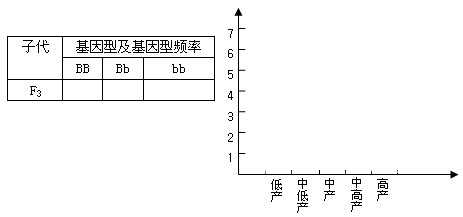

②.选出F2中抗锈病的品系自交的F3,请在上表中填写F3各种基因型的频率。

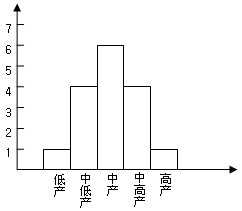

(2)另假设小麦高产与低产由两对同源染色体上的两对等位基因(A1与a1,A2与a2)控制,且含显性基因越多产量越高。现有高产与低产两个纯系杂交得F1,F1自交得F2,F2中出现了高产、中高产、中产、中低产、低产五个品系。

①.F2中,中产的基因型为_________。

②.在上图中画出F2中高产、中高产、中产、中低产、低产五个品系性状分离比的柱状图。

(1)①.6 AABB 1/16 ②.BB=1/2 Bb=1/3 bb=1/6

(2)①.A1a1A2a2、A1A1a2a2、a1a1A2A2

②.