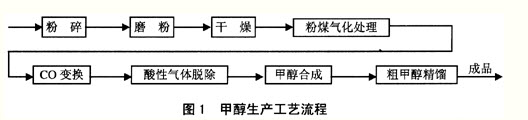

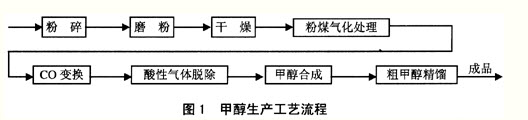

某化工厂以煤为原料生产甲醇60万t/a。该工程的主要过程为煤制备、气化、变换、脱硫脱碳、压缩、甲醇合成、精馏,工艺简图如图1所示。

表1为备煤工序废气的排放情况。工程设置污水处理站,专门用于处理煤气化污水和低温甲醇洗废水,设计规模为25m3/h,表2为污水处理站进、出水水质数据(缺部分数据,需要填写)。

表1 备煤工序废气的排放情况 | 序号 | 排放点 | 排气量/m3/h | 粉尘产生 (处理前) | 粉尘排放 (处理后) | 排放规律 | 排气筒高度/m | 治理措施 | | 浓度/(mg/m3) | 产生量/(kg/h) | 浓度/(mg/m3) | 排放量/(kg/h) | | G1 | 二级破碎机室 | 102000 | 100000 | 102000 | 45 | 4.59 | 连续 | 90 | 高效长袋低压大型脉 | | G2 | 气化煤仓 | 7200 | 10000 | 72 | 95 | 0.68 | 间断 | 65 | 冲喷吹袋式收尘器 | | G3 | 石灰石仓 | 480 | 10000 | 48 | 95 | 0.046 | 间断 | 25 | 高效袋式收尘器 | | G4 | 锅炉煤仓 | 12000 | 10000 | 120 | 95 | 1.14 | 间断 | 75 | 高效袋式收尘器 | | G5 | 一级破碎机室 | 24000 | 10000 | 240 | 95 | 2.8 | 连续 | 30 | 高效袋式收尘器 | | G6 | 第一转运站 | 7200 | 10000 | 72 | 95 | 0.8 | 连续 | 45 | 高效袋式收尘器 | | G7 | 第二转运站 | 7200 | 10000 | 72 | 95 | 0.68 | 连续 | 65 | 高效袋式收尘器 |

|

表2 污水处理站进、出水水质数据 | 编号 | 废水来源 | 废水水量/(m3/h) | 项目 | 废水水质指标 | | COD | BOD | NH3-N | CN- | SS | | W1 | 煤气化污水 | 20.0 | 浓度/(mg/L) | 300 | 200 | 200 | 10 | 50 | | 排量/(kg/h) | 6.00 | 4.00 | 4.00 | 0.20 | 1.00 | | W2 | 低温甲醇洗洗水 | 0.5 | 浓度/(mg/L) | 1500 | 975 | —— | —— | —— | | 排量/(kg/h) | 0.75 | 0.49 | —— | —— | —— | | 污水处理站进水 | 20.5 | 浓度/(mg/L) | | | | | | | 排量/(kg/h) | | | | | | | 污水处理站出水 | 20.5 | 浓度/(mg/L) | | | | | | | 排量/(kg/h) | | | | | | | 处理效率/% | | 85 | 90 | 75 | 85 | 70 |

|

该工程还设置灰渣场,距厂址1km,用于处置气化炉灰渣。设计灰渣场为200m×85m,最高标高276.6m,最低标高212.2m,经平整后容积可达40万m3。 该项目的主要风险源为甲醇贮罐,甲醇成品罐区设有2个立式内浮顶贮罐,容积为2×30000=60000m3,储存时间为21天,常压贮存。 根据本工程的甲醇和硫化氢无组织排放量计算出卫生防护距离分别为238m和165m,在厂址的周围1000m内有3个村庄,具体位置见表3。

表3 厂址周围环境敏感点 | 环境敏感点 | 方位 | 距离/m | 户数 | 人数 | | 甲村 | N | 80 | 253 | 1160 | | 乙村 | SW | 200 | 316 | 1090 | | 丙村 | E | 500 | 190 | 696 |

|

根据表1的数据计算除尘效率。