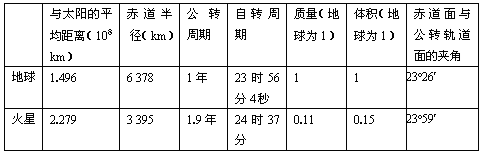

根据下表中地球和火星的有关资料回答题:

小题1:有关火星与地球的比较,正确的是:

A.火星的表面温度比地球高

B.火星绕日公转的方向与地球相同

C.火星的密度比地球大

D.火星两极点自转的角速度和线速度均比地球两极点小小题2:按地球的有关概念,将火星与地球比较,下列判断正确的是:

A.火星的极昼极夜纬度范围比地球小

B.火星的昼夜交替周期比地球短

C.火星赤道上沿东西方向运动的物体不会发生偏向

D.火星绕日公转的速度终年不变小题3:人类发射的探测器可以到达火星表面,这表明人造天体已经可以离开:

A.地月系

B.太阳系

C.银河系

D.河外星系小题4:在八大行星中,人类首选火星作为探索生命起源和进化的行星,主要是因为火星上的一些地理现象与地球上的一些地理现象相似,主要表现为

①火星两极附近与地球相似都有极昼、夜现象 ②火星、地球自转周期的长度都比较适中③火星、地球与太阳的距离都比较适中④火星和地球上都有四季变化,且四季的长度一样

A.①②④

B.②③

C.①②③④

D.③④

小题1:B

小题2:C

小题3:A

小题4:B

题目分析:

小题1:火星距离太阳较地球远,故火星的表面温度比地球低,A错误;八大行星绕日公转的方向都为自西向东,B正确;地球是八大行星中密度最大的行星,C错误;火星和地球两极点的自转角速度和线速度均为0,D错误。

小题2:由于火星的赤道面与公转轨道面的交角较地球大,故火星上极昼极夜的纬度范围较地球大,A错误;火星的自转周期较地球上略长,故火星上的昼夜交替周期较地球上长,B错误。火星和地球的赤道上的地转偏向力都为0,故水平运动物体都不发生偏向,C正确。由于火星的绕日公转轨道与地球一致均为椭圆,故有近日点和远日点,公转速度也有变化,D错误。

小题3:火星探测器顺利到达火星反映了人造天体可离开地球,但仍位于太阳系内。故选A项。

小题4:地球上生命存在的条件包括地球的自身条件(液态水、较厚的大气层和适宜的温度)和地球的宇宙环境(稳定的光照和较安全的行星际空间)。火星两极附近与地球相似都有极昼、夜现象,与生命物质存在关系不大,①错误;火星、地球自转周期的长度都比较适中,从而昼夜温差不大,②正确;火星、地球与太阳的距离都比较适中,形成适宜的温度条件,③正确;火星的公转周期较地球长,故不可能与地球的四季长短一致,④错误。

点评:本题难度一般,学生只要应用地球生命存在的条件和火星环境的相关资料进行推理,即可分析。注意因果关系和知识的迁移应用。