Jane Acompora is calculating equivalent annualized yields based on the 1.3% holding period yield of a 90 - day loan. The correct ordering of the equivalent annual money market yield MMY), effective annual yield ( EAY), and bond equivalent yield (BEY) is:()

A. MMY < EAY < BEY.

B. MMY < BEY < EAY.

C. BEY < MMY < EAY.

参考答案:B

解析:

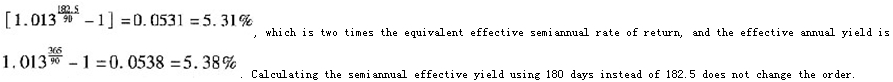

No calculations are really necessary here since the MMY involves no compounding and a 360 - day year, the BEY requires compounding the quarterly HPR to a semiannual rate and doubling that rate, and the EAY requires compounding for the entire year based on a 365 - day year. A numerical example of these calculations based on a 90 - day holding period yield of 1.3% is: the equivalent money market yield is 1.3% x 360/90 = 5.20% , the bond equivalent yield is 2×