问题

单项选择题

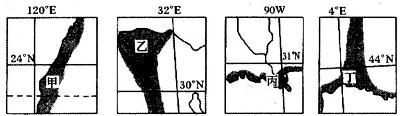

读下图,阴影部分为四个农业区,完成下列问题。

甲、乙、丙、丁的主要经济作物依次是()

A.茶叶、咖啡、棉花、橡胶

B.甘蔗、棉花、柑橘、葡萄

C.棉花、黄麻、香蕉、可可

D.花生、大豆、茶叶、棉花

答案

参考答案:B

解析:

通过观察图中所示的经纬度,可以推出甲地为中国台湾西部地区,为亚热带季风性湿润气候,适合种植甘蔗,乙地位于埃及尼罗河三角洲地区,水量、光照充足,适宜种植棉花,丙地为美国南部密西西比河下游,靠近墨西哥湾地区,为亚热带季风性湿润气候,适宜种植柑橘,丁地为法国南部地区,靠近地中海,典型经济作物是葡萄。因此本题选B。