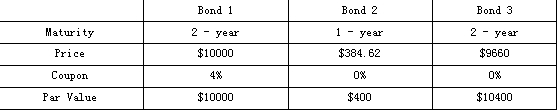

An investor gathers the following information about three U. S. Treasury annual coupon bonds:

Given the above information, how can the investor generate an arbitrage profit()

A. Purchase bond 1 while selling bonds 2 and 3.

B. Purchase bonds 2 and 3 and selling bond 1.

C. Purchase bonds 1 and 3 while selling bond 2.

参考答案:A

解析:

By purchasing bond 1 and selling bonds 2 and 3, the investor could obtain an arbitrage profit of $44.62(-10000+384.62+9660). This action will result in positive income today in return for no future obligation - an arbitrage opportunity. Notice that in year 1, the coupon payments from bond 1 will cover the bond 2 par value obligation. In year 2, the coupon payment and principal payment from bond 1 will cover the bond 3 obligation.