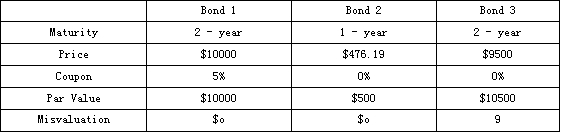

An investor gathers the following information about three U. S. Treasury annual coupon bonds:

If bond price converge to their arbitrage-free value, what should happen to the price of Bond 3()

A. Selling pressure should decrease its value.

B. Buying pressure should increase its value.

C. Selling pressure should increase its value.

参考答案:B

解析:

Currently, an arbitrage opportunity exists with the three bonds. An investor could purchase Bonds 2 and 3 and sell Bond 1 for an arbitrage-free profit of $23.81(10000-476.19-9500). This action will result in positive income today in return for no future obligation - an arbitrage opportunity. Hence, buying pressure on Bond 3 should increase its value to the point where the arbitrage opportunity would cease to exist.