问题

单项选择题

You are looking at two assets, A and B. The expected return on A is 15%, and the expected return on B is 17% , while the standard deviation of A is 20%, and the standard deviation of B is 18%. The two are correlated at 45%. What is the standard deviation of a portfolio made up of 40% A and the rest in B

A.

| A. 2.6%. |

B.

| B. 19.0%. |

C.

| C. 16.2%. |

答案

参考答案:C

解析:

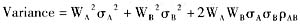

=0.42×0.202+0.62×0.182+2×0.4×0.6×0.20×0.18×0.45=0.026272

SD=0.0262721/2=0.162=16.2%