A project has estimated revenues of $10.0 million and estimated costs of $7.5 million. The following table provides information on amount billed, cash received, and cost incurred for each year of the 3-year project (data are in $ millions).()

| Year 1 | Year 2 | Year 3 | |

| Amount billed | 3.0 | 4.0 | 3.0 |

| Cash received | 3.0 | 5.0 | 2.0 |

| Cost incurred | 2.0 | 3.0 | 2.5 |

A. Using the revenue recognition method that tends to smooth income, the company will recognize profit of $ 0.83 million in year 3.

B. If ultimate payment is assured and the cost estimates are unreliable, the company will recognize profit of $1.5 million in year 2.

C. Considering this project only and using the percentage of completion method, total assets at the end of year 3 will be $ 2.5 million.

参考答案:B

解析:

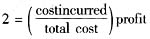

If ultimate payment is assured and the cost estimates are unreliable, the company must use the completed contract method and thus cannot recognize profits until the end of the contract. Profits in year 2 are zero. The other statements are true. At the end of year 3, the balance in the cash account will be equal to the cumulative profits, or 10-7.5=2.5. Under the percentage of completion method, the company would recognize $1 million in profits in year

. The percentage of completion method smooths income, and the profits recognized in year 3 using this method are (2.5/7.5)×2.5=0.833.

. The percentage of completion method smooths income, and the profits recognized in year 3 using this method are (2.5/7.5)×2.5=0.833.