问题

单项选择题

An investor has the following choices available: She can buy a 10 percent semi annual coupon, 10-year bond for $1000. She can reinvest the coupons at 12 percent. She can sell the bond in three years at an estimated price of $ 1050. Based on this information, the average annual rate of return over the three years is:

A.

| A. 11.5%. |

B.

| B. 13.5%. |

C.

| C.9.5%. |

答案

参考答案:A

解析:Step 1. Find the FV of the coupons and interest on interest: N=3×2=6; I=12/2=6; PMT=50; CPTFV=348.77 Step 2. Determine the value of the bond at the end of 3 years: $ 348.77+$1050.00=$1398.77 Step 3. Equate FV (1398.77) with PV (1000) over 3 years (n=6): CPTI=5.75%×2=11.5%.

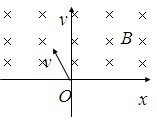

v/aB,正电荷

v/aB,正电荷 v/aB,负电荷

v/aB,负电荷