An analyst stated that lognormal distributions are suitable for describing distributions of asset prices and that normal distributions are suitable for describing asset returns. Is the analyst’s statement correct with respect to: Lognormal distributionsNormal distributions A. No No B. No Yes C. Yes Yes

参考答案:C

解析:

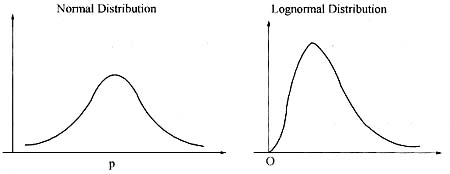

The lognormal distribution is generated by the function ex, where x is normally distributed. Since the natural logarithm, In, of eX is x, the logarithms of lognormally distributed random variables are normally distributed, thus the name. From the figure we can see that: The lognormal distribution is skewed to the right. The lognormal distribution is bounded from below by zero so that it is useful for modeling asset prices which never take negative values.