问题

单项选择题

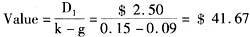

The risk-free rate is 5 percent and the expected return on the market index is 15 percent. A stock has a: Beta of 1.0. Dividend payout ratio of 40%. Return on equity (ROE) on new investments of 15%. If the stock is expected to pay a $ 2.50 dividend, its intrinsic value using dividend discount model is closest to:

A.

| A. $27.77. |

B.

| B. $41.67. |

C.

| C. $50.00. |

答案

参考答案:B

解析:

ER=RFR+beta(RM-RFR).

k=E(R)=0.05+1×(0.15-0.05)=0.15.

Retention (b)=(1-dividend payout ratio)=1-0.4=0.6.

g=ROE×b=0.15×0.6=0.09.