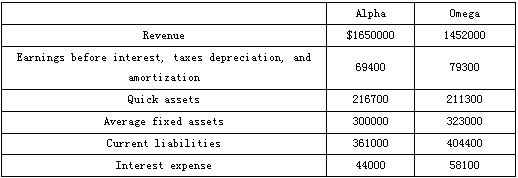

Selected financial information gathered from Alpha Company and Omega Corporation follows:

Which of the following statements is most accurate()

A. Alpha is more operationally efficient than Omega

B. Omega uses its fixed assets more efficiently than Alpha.

C. Omega has less tolerance for leverage than Alpha.

参考答案:C

解析:

Using the EBITDA coverage (EBITDA/Interest expense) to measure leverage tolerance, Omega has less tolerance for leverage. Omega’s EBITDA coverage is 1.4 ($ 79300 EBITDA/$58100 interest expense) and Alpha’s EBITDA coverage is 1.6 ($69400 EBITDA/$44000 interest expense). Using the quick ratio to measure liquidity, Alpha is more liquid than Omega. Alpha’s quick ratio is 0.6 ($216700 quick assets/S361000 current liabilities) and Omega’s quick ratio is 0.5 ($ 211300 quick assets/$ 404400 current liabilities). Using EBITDA margin to measure operational efficiency, Alpha is less operationally efficient than Omega. Alpha’s EBITDA margin is 4.2% ($69400 EBITDA/$1650000 revenue) and Omega’s EBITDA margin is 5.5% ($ 79300 EBITDA/$1452000 revenue). Using fixed asset turnover to measure the efficiency of fixed assets, Omega uses its fixed assets less efficiently than Alpha. Alpha’s fixed asset turnover is 5.5 ($1650000 revenue/$ 300000 average fixed assets) and Omega’s fixed asset turnover is 4.5 ($1452000 revenue/$ 323000 average fixed assets).