问题

单项选择题

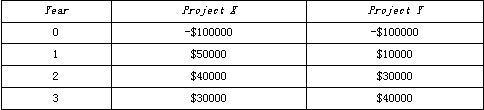

As the director of capital budgeting for Denver Corporation, an analyst is evaluating two mutually exclusive projects with the following net cash flows:

If Denver’s cost of capital is 15 percent, which project should be chosen()

A. Project X, since it has the higher IRR.

B. Neither project.

C. Project Y, since it has the higher IRR.

答案

参考答案:B

解析:

NPV for Project X=-100000+50000/(1.15)1+40000/(1.15)2+30000/(1.15)3+10000/(1.15)4=-833

NPV for Project Y=-100000+10000/(1.15)1+30000/(1.15)2+40000/(1.15)3+60000/(1.15)4=-8014

Reject both projects because neither has a positive NPV.