问题

单项选择题

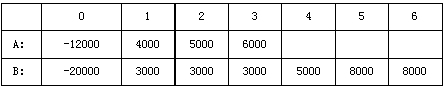

Wreathfield, Inc. is choosing between two mutually exclusive projects. The cash flows for the two projects are below. The firm has a cost of capital of 10%, and the risk of the projects is equivalent to the average risk of the firm.

The internal rate of return (IRR) of projects A and B respectively are closest to: Project A Project B()①A. 11.22% 10.50%

②B. 12.33% 14.26%

③C. 11.22% 14.26%

A.①

B.②

C.③

答案

参考答案:A

解析:

|

|