A firm has average days of receivables outstanding of 22 compared to an industry average of 29 days. An analyst would most likely conclude that the firm:()

A. may have credit policies that are too strict.

B. makes less credit sales than the average firm in its industry.

C. has a lower cash conversion cycle than its peer companies.

参考答案:A

解析:

The firm’s average days of receivables should be close to the industry average. A significantly lower average days receivables outstanding, compared to its peers, is an indication that the firm’s credit policy may be too strict and that sales are being lost to peers because of this. We can not assume that stricter credit controls than the average for the industry are "better." We cannot conclude that credit sales are less, they may be more, but just made on stricter terms. The average days of receivables are only one component of the cash conversion cycle.

,

, 和

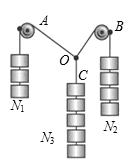

和 ,回答下列问题:

,回答下列问题:

,

,

,

,

,

,