阅读下文,完成文后各题。

美丽的谎言

杨建国

东礁岛上,只有一名老兵和一名新兵。

岛上只有一座航标灯,老兵和新兵日复日、夜复夜地与航标灯为伴,除了守灯,白天只有听单调的海涛声,夜晚只能数满天的星斗。

老兵说,竖耳听涛,睁眼看星,多有诗意。

新兵听涛看星,觉得枯燥无味,百无聊赖。

老兵闲暇之时提笔写涛声、写星斗、写彩云、写海鸥、写轮船、写战舰,新兵觉得挺好玩的,也跟着拿起了笔。

三个月后,老兵的一首小诗《望夜空》在当地的《东礁文艺》上发表了。老兵欣喜若狂,新兵羡慕不已。

老兵的 小诗后面署有“责任编辑兰兰”。新兵好奇地问兰兰是男还是女。

老兵说,当然是女的。

新兵脸一红,嗫嚅着问,漂亮吗?

老兵说,一定漂亮。

一个星期后,老兵亲自去了趟《东礁文艺》编辑部。回来时,老兵兴奋地对新兵说见到了兰兰,兰兰也收到了你的诗稿,兰兰还称赞你的诗写得有激情。

新兵的脸红着问,兰兰一定很漂亮,是吗?

老兵爽快答道:当然。

老兵兴奋地对新兵说,见到了兰兰。

从此新兵感到,彩云绚丽多彩,涛声悦耳动听。新兵盼望满两年兵龄,可以一个月上一次岸,那时就到编辑部去看看兰兰——那一定是个扎着两条羊角辫子,长得白白净净的瓜子脸的俏姑娘。

一天夜里,黑黝黝的天空中霹雳轰鸣,狂风如游龙般乱窜,倾盆大雨直泻东礁岛,整个世界如同染了墨般的漆黑。隐约闪烁的只有那座不知耸立了多少年的航标灯。

新兵被炸雷惊起了床,连唤了几声老兵,不见老兵回应。新兵抓起了手电筒,连雨衣也来不及披就投入了雨幕中,奔向航标灯。

借着时隐时现的闪电,新兵发现了航标灯下斜倚着一个人,跑近了才发现是老兵。

老兵双手紧紧地抓住了一条从机房延伸到航标灯座的电线的另一端。双眼紧闭,脸色苍白,额头上的血水混着雨水直往脸颊下淌。航标灯没有熄,老兵却没有醒过来,新兵如雕塑般呆立在雨中……

东礁岛上多了一座新坟,新坟倚着航标灯。

几个月后,东礁岛上又来了一名新兵。原来的新兵变成了老兵。老兵可以上岸了,他迫不及待的走进了《东礁文艺》编辑部,指名道姓要找名叫兰兰的姑娘。一个年近花甲、老态龙钟的老头操着沙哑的嗓门说,我就是兰兰。

老兵使劲的摇着头,死也不相信他就是兰兰。直到编辑部主任拍着胸口,以人格担保说眼前这个老头就是兰兰时,老兵恍如梦醒般点点头,似自言自语地说,是兰兰,是兰兰。

东礁岛上依旧住着一老一新两个兵。

老兵继续写诗,写涛声,写海鸥、写战舰,还写以前的老兵。

新兵觉得挺好玩的,也跟着写。

有一天,老兵的诗在《东礁文艺》上发表了。小诗的下面依旧署着“责任编辑兰兰”。新兵好奇地问老兵,兰兰是男的还是女的?

老兵说,当然是女的。

新兵脸一红,嗫嚅着问,漂亮吗?

老兵双眼深沉地注视着大海,注视着航标灯,注视着航灯旁的新坟,说,是的,很漂亮……

小题1:下列对小说有关内容的赏析和概括最恰当的两项是(5分)

A.这篇小说塑造了老兵和新兵两个典型形象,歌颂老兵舍已为人、默默奉献的高尚品质,批评新兵缺少生活的情趣。

B.小说中的老兵和新兵形成鲜明的对比。老兵任劳任怨,热爱生活;新兵则害怕困难,缺少责任感。

C.这篇小说非常注重人物的神态描写。精到的神态描写往往意味深长,给人以深思,并将读者带入人物的内心世界,如结尾对老兵的“注视”的神态描写就很有意蕴。

D.这篇小说用“老兵”“新兵”这种代表一类人的名称来称呼人物使小说具有更深层的含义——在祖国的边防有无数这样默默无闻的哨兵,他们一辈地奉献着自己的青春。E.编辑兰兰竟是一个年过花甲的老头,名字和人之间强烈的反差为小说增添了一份也人意料的喜剧之息。

小题2:结合具体事迹,简析第一个老兵的形象。(6分)

小题3:阅读全文,分条简述小说以“美丽的谎言”为题的好处。(6分)

小题4:小说第二部分几乎是第一部分的翻版,这样构思是否有重复单调之嫌?谈谈你的看法。(8分)

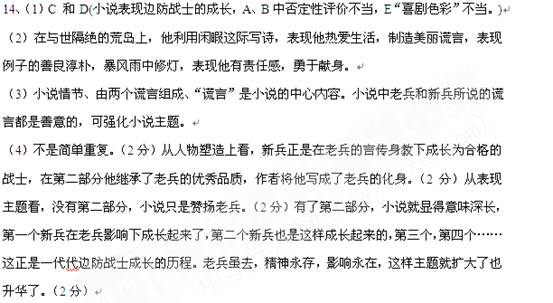

小题1:无

小题2:无

小题3:无

小题4:无