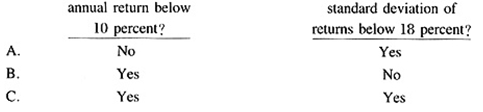

An investor does research about annual return and standard deviation of returns, and is considering the purchase of two securities issued by different companies operating in different industries. Each security has an expected annual return of 10 percent and an expected standard deviation of retums of 18 percent. Regardless of the weights selected, will a portfolio composed of the two securities most likeLy have an expected:()

A.A

B.B

C.C

参考答案:A

解析:

投资组合中两个证券的投资收益率都为10%,不管是什么权重,最后投资组合的收益率也为10%。两个证券来自不同的行业,说明它们的相关系数至少不为1。如果相关系数是l,则两个资产组合的收益率标准差为18%。如果相关系数小于1,则这两个资产组合的收益率标准差小于18%。