问题

单项选择题

An analyst does research about the impact of tax rate changes on a company's financial statements. For existing deferred tax assets and liabilities, an increase in income tax rate:

A. increases both deferred tax assets and deferred tax liabilities.

B. decreases both deferred tax assets and deferred tax liabilities.

C. decreases deferred tax assets and increases deferred tax liabilities.

答案

参考答案:A

解析: 税率的改变对于DTL和DTA的影响:税率的改变不但对当期的income statement有影响,而且对在balance sheet中的DTA和DTL也会有影响。

Tax rate上升,令资产负债表中的DTL上升和DTA上升。

Tax rate下降,令资产负债表中的DTL下降和DTA下降。

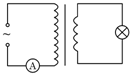

sin100πt (V)的 正弦交流电源,图中电流表内阻不计.副线圈接入“110V,60W”灯泡一只,且灯光正常发光.下列说法正确的是( )

sin100πt (V)的 正弦交流电源,图中电流表内阻不计.副线圈接入“110V,60W”灯泡一只,且灯光正常发光.下列说法正确的是( ) /22 A

/22 A