A stock, which currently does not pay a dividend, is expected to pay its first dividend of $1.00 in five years (D5=$1.00). Thereafter, the dividend is expected to grow at an annual rate of 25 percent for the next three years and then grow at a constant rate of 5 percent per year thereafter.

The required rate of return is 10. 3 percent. What is the value of the stock today()

A. $20.65.

B. $20.95.

C. $22.72.

参考答案:A

解析:

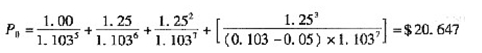

This is essentially a two-stage DDM problem. Discounting all future cash flows, we get:

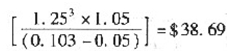

Note that the constant growth formula can be applied to dividend 8 because it will grow at a constant rate (5%) forever. It is preferable to do this with the right keystrokes on the calculator but it is a bit tricky. Since the first non-zero cash flow occurs in year 5, we have to communicate this information to the calculator correctly to get the indicated solution. Using the CF function the sequence of keystrokes would be : CF0=0; CF1=0, F1=4; CF2=1.00; CF3=1.25; CF4=1.5625; CF5=40.6471; I=10.3; CPT NPV=$20.647. When we input the first dividend as CF2=1.00, we are telling the calculator that this is really received in the fifth year and it is then discounted correctly. Note that CF5 is made up of two components-the dividend that is paid in year 8=1.253=1.93125 plus the present value of the constantly growing ( at 5% ) perpetuity =

. These must be added since they are effectively received at the same point in time.

. These must be added since they are effectively received at the same point in time.