The following data pertains to an investor's stock:

The stock will pay no dividends for two years.

The dividend three years from now is expected to be $1.

Dividends are expected to grow at a 7% rate from that point onward.

If the investor requires a 17 percent return on their investments, how much will the investor be willing to pay for this stock now()

A. $6.24.

B. $7.31.

C. $8.26.

参考答案:B

解析:

Time line=$0 now; $0 in year 1; $0 inyear2; $1 in year 3.

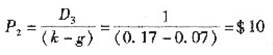

Note that the price is always one year before the dividend date. Solve for the PV of $10 to be

received in two years. FV=10; N=2; I=17; CPT→PV=$7.31.