Joshua Douglas, CFA, is interested in the relationship between the stock prices of two companies, Sonata Inc. and Prius Inc. After downloading a time series of stock prices for each company, Douglas concludes that Sonata Inc. has a variance equal to 25.0 percent and Prius has a variance equal to 20.0 percent. If the covariance between the two stocks is -0.10, the correlation coefficient is:()

A. negative, and indicates that a 1.0% increase in the price of Sonata would be accompanied by a 2.0% decrease in the price of Prius.

B. negative, and indicates that a 10.0% increase in the price of Sonata would be accompanied by a 4.5% decrease in the price of Prius.

C. positive, and indicates that a 1.0% increase in the price of Sonata would be accompanied by a 2.0% increase in the price of Prius.

参考答案:B

解析:

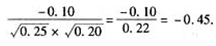

If the covariance is negative, the correlation must be negative. Calculate the correlation as follows:

The correlation indicates that as the stock price of either Prius or Sonata increases, the other stock’s price should decrease by 45% of the first stock’s increase. Thus a 100% increase in the price of Sonata would be accompanied by a 45% decrease in the price of Prius.

The correlation indicates that as the stock price of either Prius or Sonata increases, the other stock’s price should decrease by 45% of the first stock’s increase. Thus a 100% increase in the price of Sonata would be accompanied by a 45% decrease in the price of Prius.