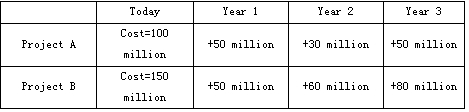

BPM Ltd. has the following capital structure: 40 percent debt and 60 percent equity. The cost of retained earnings is 13 percent, and the cost of new common stock is 16 percent. BPM will not have any retained earnings available in the upcoming year. Its before tax cost of debt is 8 percent, and its corporate tax rate is 40 percent. BPM is considering between two mutually exclusive projects that have the following cash flows:

Which project should BPM choose()

A. Project B since its NPV is $ 22 million.

B. Project A since its NPV is $16 million.

C. Project A since its net present value (NPV) is +$5.01 million.

参考答案:C

解析:

Use the Marginal cost of capital(=WACCnew equity)as the discount rate to calculate NPV. WACCnew equity=(Wd×(kd×(1-T)))+(Wce+×Ke)

=[0.4×0.08×(1-0.4)]+[0.6×0.16]=11.52%

NPV of project A=-100+50/1.1152+30/1.11522+50/1.11523=+5.01

NPV of project B=-150+50/1.1152+60/1.11522+80/1.11523=+0.76