问题

单项选择题

Davis Company, Inc. (DCI) earned $5 a share last year and paid dividend of $2 a share. The company is expected to grow by 8 percent annually and continue its payout ratio for the foreseeable future. An investor with an 11 percent required return expects to sell the stock at $ 75 two years from now. The maximum amount that an investor should be willing to pay for DCI stock today is closest to:()

A. $58.68.

B. $64.71.

C. $66.67.

答案

参考答案:B

解析:

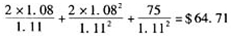

The holding period is two years. The value of the stock is