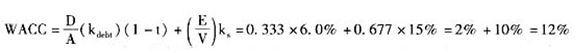

The following data applies to LeVeit Company: LeVeit has a target debt-to-equity ratio of 0.5. LeVeit’s bonds are currently yielding 10%. LeVeit is a constant growth firm that just paid a dividend of $ 3.00. LeVeit’s stock sells for $ 31.50 per share. Return on Equity (ROE) is 20%. The dividend payout ratio is 75%. The company’s marginal tax rate is 40%. The company’s weighted after-tax cost of capital is()

A. 10. 5%.

B. 11.0%.

C. 12.0%.

参考答案:C

解析:

First find the growth rate: ROE×(1-dividend payout)=0.20×0.25=5%.

kce=D1/P0+g=3×1.05/31.50+0.05=0.15 or 15%

kd(1-t)=10%×(1-0.4)=6%

If the company has a debt-to-equity ratio of 0.5, it will have $ 0.50 in debt for each $1.00 in equity. V=debt+equity=0.5+1=1.5. Therefore, the weight is 33.3% (0.5/1.5) for the debt component and 66.7% (1.0/1.5) for the equity component.