问题

计算题

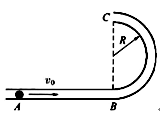

如图所示,光滑圆管形轨道AB部分平直,BC部分是处于竖直平面内半径为R的半圆,圆管截面半径r<<R.有一质量为m、半径比r略小的光滑小球以水平初速度v0射入圆管,问:

(1)若要使小球能从C端出来,初速度v0,多大?

(2)在小球从C端出来的瞬间,对管壁压力有哪几种典型情况?初速v0各应满足什么条件?

答案

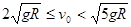

(1) (2)①当N=0时,

(2)①当N=0时, ②对管壁有向上的压力,

②对管壁有向上的压力, ③对管壁有向下的压力,

③对管壁有向下的压力,

题目分析:(1)当球恰好能从C端出来时,速度为零,根据机械能守恒定律求解初速度v0.

(2)以小球为研究对象,小球经过C点时速度不同,管壁对球的作用力大小和方向不同,分析讨论:当管壁对球无作用力时,在C点由重力提供小球的向心力,由牛顿第二定律求出在C点的速度,由机械能守恒定律求出初速v0.当初速度大于和小于临界速度时,由向心力知识分析管壁对球的作用力大小和方向.

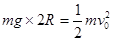

(1)当球恰好能从C端出来时,速度vC=0.根据机械能守恒定律得: ,解得

,解得 ,所以要使小球能从C端出来,初速度

,所以要使小球能从C端出来,初速度

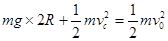

(2)在小球从C端出来的瞬间,对管壁压力有三种典型情况:

(3)①当管壁对球无作用力时,即N=0时, ,解得

,解得 ,根据机械能守恒定律得

,根据机械能守恒定律得 ,解得

,解得

②当管壁对球的作用力方向向下时,球对管壁的压力方向向上,此时

③当管壁对球的作用力方向向上时,球对管壁的压力方向向下,此时

点评:本题难度中等,对于小球在管子里的运动情形与轻杆模型类似,关键抓住临界情况:小球恰好到最高点和在最高点恰好不受管壁作用力两种情况