曾几何时,各公司都是商业银行家的客户,并没有进入资本市场。一段时间以来,念念不忘那段时光的商业银行家们纷纷把热切的目光投向中国。经监管部门批准,中国的银行存款利率为2%,贷款利率为6%多一点,这是不容改变的事实。虽然存在大量的呆账,但存贷利率差价如此之大,给任何表面上守信用的银行都提供了盈利空间。这很像曾经被亲切地称为3—3—3制的纽约银行业,即存款给3%的利率,放贷时再加3%,然后下午3点下班(去打高尔夫球)。

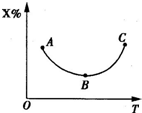

然而,一切正在发生变化。资本市场生机勃勃,而且两家著名学术机构最近研究表明,中国经济一些不规范、至今未纳入监管范围的市场甚至也隐约出现了一些颇为有意思的活动,各公司将从国外赚得的巨额利润拿到这里再利用。

参考答案:

Commercial bankers, nostalgic for the days when corporate customers still belonged to them rather than the capital markets, have for some time gazed longingly at China. Under sanction from regulators, Chinese banks pay B% for deposits, lend at a bit more than F%, and that is that. Loan losses are high, but the spreads are so large that with any semblance of credit discipline there should be room for profits. It is rather like what was once fondly referred to in New York as C--C--C banking, pay C%, charge C% more, and get out of the office (and on the golf course) by C p. m.

Change, however, is on its way. Capital--markets activity is growing and, according to recent research from two prominent academics, there may even be flickers of interesting activity in unregulated and hitherto unwatched corners of China’s economy, where companies are recycling vast profits made abroad.