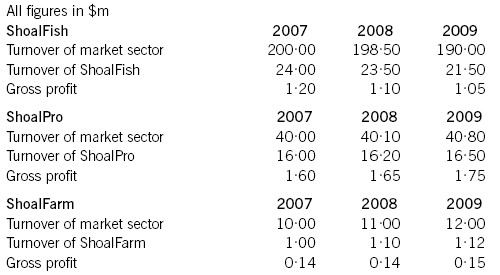

IntroductionShoal plc is a well-known corporate organisation in the fi sh industry. It owns 14 companies concerned with fi shing and related industries.This scenario focuses on three of these companies:ShoalFish Ltd – a fi shing fl eet operating in the western oceansShoalPro Ltd – a company concerned with processing and canning fi shShoalFarm Ltd – a company with saltwater fi sh farms.Shoal plc is also fi nalising the purchase of the Captain Haddock chain of fi sh restaurants.ShoalFishShoal plc formed ShoalFish in 2002 when it bought three small fi shing fl eets and consolidated them into one fl eet. The primary objective of the acquisition was to secure supplies for ShoalPro. 40% of the fi sh caught by ShoalFish are currently processed in the ShoalPro factories. The rest are sold in wholesale fi sh markets. ShoalFish has recorded modest profi ts since its formation but it is operating in a challenging market-place. The western oceans where it operates have suffered from many years of over-fi shing and the government has recently introduced quotas in an attempt to conserve fi sh stocks.ShoalFish has 35 boats and this makes it the sixth largest fl eet in the western oceans. Almost half of the total number of boats operating in the western oceans are individually owned and independently operated by the boat’s captain. Recent information for ShoalFish is given in Figure 1.ShoalProShoalPro was acquired in 1992 when Shoal plc bought the assets of the Trevarez Canning and Processing Company. Just after the acquisition of the company, the government declared the area around Trevarez a ‘zone of industrial assistance’. Grants were made available to develop industry in an attempt to address the economic decline and high unemployment of the area. ShoalPro benefi ted from these grants, developing a major fi sh processing and canning capability in the area. However, despite this initiative and investment, unemployment in the area still remains above the average for the country as a whole.ShoalPro’s modern facilities and relatively low costs have made it attractive to many fi shing companies. The fish received from ShoalFish now accounts for a declining percentage of the total amount of fi sh processed and canned in its factories in the Trevarez area. Recent information for ShoalPro is given in Figure 1.ShoalFarmShoalFarm was acquired in 2004 as a response by Shoal plc to the declining fi sh stocks in the western oceans. It owns and operates saltwater fi sh farms. These are in areas of the ocean close to land where fi sh are protected from both fi shermen and natural prey, such as sea birds. Fish stocks can be built up quickly and then harvested by the fi sh farm owner. Shoal plc originally saw this acquisition as a way of maintaining supply to ShoalPro.Operating costs at ShoalFarm have been higher than expected and securing areas for new fi sh farms has been diffi cult and has required greater investment than expected. Recent information for ShoalFarm is given in Figure 1.

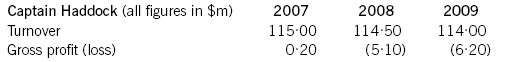

Figure 1: Financial data on individual companies 2007–2009Captain HaddockThe Captain Haddock chain of restaurants was founded in 1992 by John Dory. It currently operates one hundred and thirty restaurants in the country serving high quality fi sh meals. Much of Captain Haddock’s success has been built on the quality of its food and service. Captain Haddock has a tradition of recruiting staff directly from schools and universities and providing them with excellent training in the Captain Haddock academy. The academy ensures that employees are aware of the ‘Captain Haddock way’ and is dedicated to the continuation of the quality service and practices developed by John Dory when he launched the fi rst restaurant. All management posts are fi lled by recruiting from within the company, and all members of the Captain Haddock board originally joined the company as trainees. In 1999 the Prime Minister of the country identifi ed Captain Haddock academy as an example of high quality in-service training. In 2000, Captain Haddock became one of the thirty best regarded brands in the country.In the past few years, the fi nancial performance of Captain Haddock has declined signifi cantly (see Figure 2) and the company has had diffi culty in meeting its bank covenants. This decline is partly due to economic recession in the country and partly due to a disastrous diversifi cation into commercial real estate and currency dealing. The chairman and managing director of the company both resigned nine months ago as a result of concern over the breaking of banking covenants and shareholder criticism of the diversifi cation policy. Some of the real estate bought during this period is still owned by the company. In the last nine months the company has been run by an interim management team, whilst looking for prospective buyers. At restaurant level, employee performance still remains relatively good and the public still highly rate the brand. However, at a recent meeting one of the employee representatives called for a management that can ‘effectively lead employees who are increasingly demoralised by the decline of the company’.Shoal plc is currently fi nalising their takeover of the Captain Haddock business. The company is being bought for a notional $1 on the understanding that $15 million is invested into the company to meet short-term cash fl ow problems and to improve liquidity. Shoal plc’s assessment is that there is nothing fundamentally wrong with the company and that the current fi nancial situation is caused by the failed diversifi cation policy and the cost of fi nancing this. The gross profi t margin in the sector averages 10%.Captain Haddock currently buys its fi sh and fi sh products from wholesalers. It is the intention of Shoal plc to look at sourcing most of the dishes and ingredients from its own companies; specifi cally ShoalFish, ShoalPro and ShoalFarm. Once the takeover is complete (and this should be within the next month), Shoal plc intends to implement signifi cant strategic change at Captain Haddock so that it can return to profi tability as soon as possible. Shoal plc has implemented strategic change at a number of its acquisitions. The company explicitly recognises that there is no ‘one right way’ to manage change. It believes that the success of any planned change programme depends on an understanding of the context in which the change is taking place.

Figure 1: Financial data on individual companies 2007–2009Captain HaddockThe Captain Haddock chain of restaurants was founded in 1992 by John Dory. It currently operates one hundred and thirty restaurants in the country serving high quality fi sh meals. Much of Captain Haddock’s success has been built on the quality of its food and service. Captain Haddock has a tradition of recruiting staff directly from schools and universities and providing them with excellent training in the Captain Haddock academy. The academy ensures that employees are aware of the ‘Captain Haddock way’ and is dedicated to the continuation of the quality service and practices developed by John Dory when he launched the fi rst restaurant. All management posts are fi lled by recruiting from within the company, and all members of the Captain Haddock board originally joined the company as trainees. In 1999 the Prime Minister of the country identifi ed Captain Haddock academy as an example of high quality in-service training. In 2000, Captain Haddock became one of the thirty best regarded brands in the country.In the past few years, the fi nancial performance of Captain Haddock has declined signifi cantly (see Figure 2) and the company has had diffi culty in meeting its bank covenants. This decline is partly due to economic recession in the country and partly due to a disastrous diversifi cation into commercial real estate and currency dealing. The chairman and managing director of the company both resigned nine months ago as a result of concern over the breaking of banking covenants and shareholder criticism of the diversifi cation policy. Some of the real estate bought during this period is still owned by the company. In the last nine months the company has been run by an interim management team, whilst looking for prospective buyers. At restaurant level, employee performance still remains relatively good and the public still highly rate the brand. However, at a recent meeting one of the employee representatives called for a management that can ‘effectively lead employees who are increasingly demoralised by the decline of the company’.Shoal plc is currently fi nalising their takeover of the Captain Haddock business. The company is being bought for a notional $1 on the understanding that $15 million is invested into the company to meet short-term cash fl ow problems and to improve liquidity. Shoal plc’s assessment is that there is nothing fundamentally wrong with the company and that the current fi nancial situation is caused by the failed diversifi cation policy and the cost of fi nancing this. The gross profi t margin in the sector averages 10%.Captain Haddock currently buys its fi sh and fi sh products from wholesalers. It is the intention of Shoal plc to look at sourcing most of the dishes and ingredients from its own companies; specifi cally ShoalFish, ShoalPro and ShoalFarm. Once the takeover is complete (and this should be within the next month), Shoal plc intends to implement signifi cant strategic change at Captain Haddock so that it can return to profi tability as soon as possible. Shoal plc has implemented strategic change at a number of its acquisitions. The company explicitly recognises that there is no ‘one right way’ to manage change. It believes that the success of any planned change programme depends on an understanding of the context in which the change is taking place.

Figure 2: Financial information for Captain Haddock 2007–2009Required:

Figure 2: Financial information for Captain Haddock 2007–2009Required:

(a) In the context of Shoal plc’s corporate-level strategy, assess the contribution and performance of ShoalFish, ShoalPro and ShoalFarm. Your assessment should include an analysis of the position of each company in the Shoal plc portfolio. (15 marks)

参考答案:ShoalFishA PESTEL analysis of ShoalFish would focus on the fact that it is fi shing in an area where fi sh stocks are rapidly declining (environmental) and it is increasingly exposed to government intervention and restrictions (political). It is a relatively small player (AB% market share) in a large, but declining market place (E% over two years). Profi ts are declining, although ShoalFish appear to have arrested the decline in the profi t margin. The B00I gross profi t margin (D·I%) shows an increase over the B00H figure (D·G%). This may mean that the company has been able to bring operating costs in line with the declining turnover.In terms of the Boston Box, it has the characteristics of a dog, a company with a small market share in a declining market. However, Shoal plc perceives that there are important synergies between ShoalFish and the other companies in the Shoal plc portfolio. For example, it helps secure a signifi cant proportion of the raw materials required by ShoalPro. ShoalPro is also ShoalFish’s main customer, accounting for D0% of the company’s catch. ShoalFish also has an intended role following the purchase of the Captain Haddock group of restaurants. Shoal plc would like ShoalFish to directly supply the Captain Haddock restaurants and so potentially reduce raw material costs at Captain Haddock.Shoal plc needs to look carefully at the viability of maintaining this fl eet. They are operating in an area where owner-skippers are very common (almost half of the boats in the western oceans are owned and operated by the boat’s captain). There may be an opportunity for ShoalFish to sell, lease or rent their ships, perhaps to individual owners, with the promise of guaranteed sales to ShoalPro (and potentially Captain Haddock). Alternatively, they could tolerate declining performance from this part of the portfolio, in the knowledge that it forms an important part of the supply chain for other companies in the portfolio.ShoalProShoalPro is a profi table and expanding organisation. A signifi cant percentage of its raw fi sh supply is currently provided by ShoalFish, but this percentage is declining as it increasingly processes fi sh for other companies. It is in a mature, but still expanding (+B% from B00G to B00I) market-place where it holds a signifi cant (D0%) and slightly increasing market share. Gross profi t margins are improving slightly (from A0% in B00G to A0·F% in B00I), suggesting that costs are increasing at a slower rate than revenues.Its consistent profi tability would classify this business, using Boston Box terminology, as a cash cow. A company with a signifi cant market share in a low growth market.A PESTEL analysis would focus on the fact that ShoalPro factories are in a region which attracts national grants due to high local unemployment (political and economic). This reduces operating costs and the persistence of high unemployment suggests that a local skilled workforce is still accessible to ShoalPro (socio-cultural). Analysis suggests that ShoalPro is an important part of the Shoal plc portfolio and should be retained and maintained.ShoalFarmShoalFarm is a relatively new acquisition. It currently has a relatively low market share (A0%) in an expanding market-place. ShoalFarm is itself growing (+AB% from B00G to B00I), but not as fast as its market (+B0% in the same period). A PESTEL analysis would reveal a market-place that is perceived as ethically acceptable, stressing the conservation of fi sh supplies (socio-cultural). It seems likely that this will increase in importance in the future although the diffi culty of fi nding potential sites (environmental) may be a signifi cant factor. Gross profi t is high (AD% in B00G, comfortably out-performing ShoalFish and ShoalPro) but declined in B00H (AB·G%), recovering slightly in B00I (AC·C%).ShoalFarm may also have a signifi cant role to play in providing raw materials for both ShoalPro and the potential acquisition – Captain Haddock restaurants. In terms of the Boston Box classifi cation, ShoalFarm is probably a question mark or problem child. It needs increasing investment to ensure that it becomes a key player in a signifi cant market-place. If Shoal plc is prepared to do this, then the recommendation is that they should expand and develop. If they do not – and the potential synergies with Captain Haddock are not realised – they may wish to divest.Overall, the three companies can be seen as integrated parts in a comprehensive value chain. Confl icting environmental forces are at work, on the one hand reducing the level of dependency between the companies and, on the other hand, reinforcing the competitive advantages (synergies) of being in a vertically integrated group. The potential acquisition of Captain Haddock could further enhance these advantages but only if the correct inter-fi rm trading relationships are established.