问题

单项选择题

A company is determining the cost of debt to use in its weighted average cost of capital. It has recently issued a 10-year, 6 percent semiannual coupon bond for $ 864. The bond has a maturity value of $1 000. If the marginal tax rate is 35 percent, the cost of debt they should use in their calculation is closest to:()

A. 4.3%.

B. 5.2%.

C. 6.1%.

答案

参考答案:B

解析:

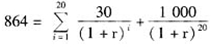

[分析]: 首先,计算债券的到期收益率(债务的税前成本):

解得半年期到期收益率r=4%,从而到期收益率YTM=8%,亦即债务的税前成本为8%。进一步地,可以得到(税后)债务成本=8%×(1-35%)=5.2%。 [考点] 固定利率债务资金成本的计算

解得半年期到期收益率r=4%,从而到期收益率YTM=8%,亦即债务的税前成本为8%。进一步地,可以得到(税后)债务成本=8%×(1-35%)=5.2%。 [考点] 固定利率债务资金成本的计算