A company borrows $15 million from a bank for 1 year at a rate of LIBOR, currently 4.75 percent, plus 50 basis points. At the same time, the company enters a 1-year interest rate swap to pay the fixed rate of 5.25 percent and receive LIBOR. Payments are made on the basis of 180 days in the settlement period. Floating payments are made on the basis of 360 days a year while fixed payments are made on the basis of 365 days a year. LIBOR is 5.00 percent on the first settlement. The company’s total interest expense for the loan and swap for the first settlement period is closest to:()

A. $388400.

B. $425900.

C. $444600.

参考答案:B

解析:

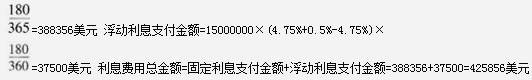

[分析]: 由题干可知,在互换合约第一次交割时,该厂商向互换合约对手方支付5.25%的固定利息,同时向银行支付4.75%加50个基点(0.5%)的浮动利息。此外,还从互换合约对手方处获得4.75%的浮动利息。 固定利息支付金额=15000000×5.25%×

[考点] 货币互换、利率互换与股权互换

[考点] 货币互换、利率互换与股权互换