问题

单项选择题

A European stock index call option has a strike price of $1 160 and a time to expiration of 0.25 years. Given a risk-flee rate of 4 percent, if the underlying index is trading at $1 200 and has a multiplier of 1, the lower bound for the option price is closest to:()

A. $ 28.29.

B. $ 40.00.

C. $ 51.32.

答案

参考答案:C

解析:

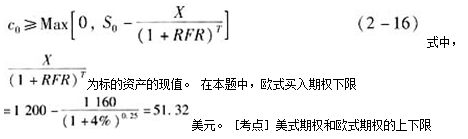

[分析]: 欧式买入期权下限表述为: