An investor goes long an FRA that expires in 30 days for which the underlying is 90-day LIBOR for a notional of $10 million. A dealer quotes this instrument at 4.5 percent. At expiration, 60-day LIBOR is 3.5 percent and 90-day LIBOR is 4 percent. The payment made at expiration is closest to:()

A. $12 376 from the investor to the dealer.

B. $12 376 from the dealer to the investor.

C. $16 570 from the investor to the dealer.

参考答案:A

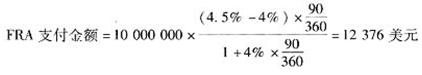

解析:

[分析]: 在衍生产品市场中,交易者持有远期利率协议(FRA)的多头通常基于未来利率上涨的预期。如果在远期利率协议到期时的利率水平高于协议利率,则持有FRA多头的交易者将获得交易对手方相应金额的支付;反之,如果在远期利率协议到期时的利率水平低于协议利率,则持有FRA多头的交易者将向交易对手方支付相应金额。 在本题中,由于投资者持有远期利率协议(FRA)的多头,且到期时的利率水平(4%)低于协议利率(4.5%),因而该投资者应向经纪商支付相应金额。

即在远期利率协议到期时,投资者应向经纪商支付12376美元,本题的正确选项为A。 [考点] 远期利率协议(FRA)

即在远期利率协议到期时,投资者应向经纪商支付12376美元,本题的正确选项为A。 [考点] 远期利率协议(FRA)