问题

单项选择题

An analyst estimates that an initial investment of $500 000 in a venture capital project will pay $6 million at the end of five years if the project succeeds and that the probability the project survives to the end fifth year is 25 percent. The required rate of return for the project is 19 percent. The expected net present value of the venture capital investment is closest to.()

A. $128754.

B. $152632.

C. $236486.

答案

参考答案:A

解析:

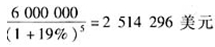

[分析]: 如果投资项目在5年后获得成功,则投资项目回报的现值为

,从而上述投资回报的净现值为2514296-500000=2014296美元。 风险资本投资的预期净现值=2014296×25%+(-500000)×75%=128574美元 [考点] 根据条件概率计算风险资本项目净现值(NPV)

,从而上述投资回报的净现值为2514296-500000=2014296美元。 风险资本投资的预期净现值=2014296×25%+(-500000)×75%=128574美元 [考点] 根据条件概率计算风险资本项目净现值(NPV)