问题

单项选择题

A company is planning a new issue of $100 par preferred stock with a 12 percent dividend. The preferred stock can be sold for $95 per share and the company must pay flotation costs of 5 percent of the market price. Assuming a marginal tax rate of 40 percent, the after-tax rate of 40 percent, the after-tax cost of the preferred stock is closest to:()

A. 8.0%.

B. 12. 6%.

C. 13.3%.

答案

参考答案:C

解析:

不可赎回的(noncallable)且不可转换的优先股资金成本(kp)计算公式为: 式中,Dp表示优先股股息,P表示优先股的价格。

式中,Dp表示优先股股息,P表示优先股的价格。

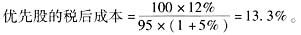

在本题中, 需要注意的是,与发行债券不同,发行股票并不享有税金优势,从而本题的计算无须考虑边际税率的影响。

需要注意的是,与发行债券不同,发行股票并不享有税金优势,从而本题的计算无须考虑边际税率的影响。

[考点] 优先股资金成本的计算