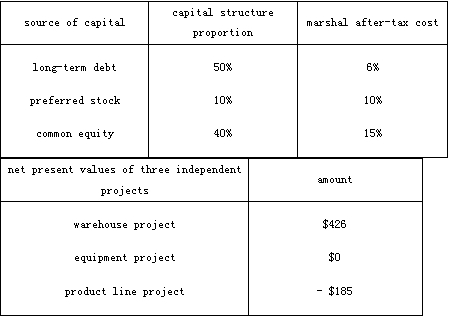

An analyst gathered the following information about a company that expects to fund its capital budget without issuing any additional shares of common stock:

If no significant size or timing differences exist among the projects and the projects all have the same risk as the company, which project has an internal rate of return that exceeds 10 percent()

A. All three projects.

B. The warehouse project only.

C. The warehouse project and the equipment project.

参考答案:B

解析:

[分析]: 该厂商的加权平均资金成本为: WACC=6%×50%+10%×10%+15%×40%=10% 为了判断本题中的三个投资项目中的哪个项目的内部回报率高于厂商的加权平均资金成本(10%),只需确定其中哪个项目的净现值为正即可。由本题题干可知,只有仓储项目的净现值为正,从而可知仅有仓储项目满足条件,本题的正确选项为B。 [考点] 投资项目可行性的主要判定方法;加权平均资金成本与税金的影响