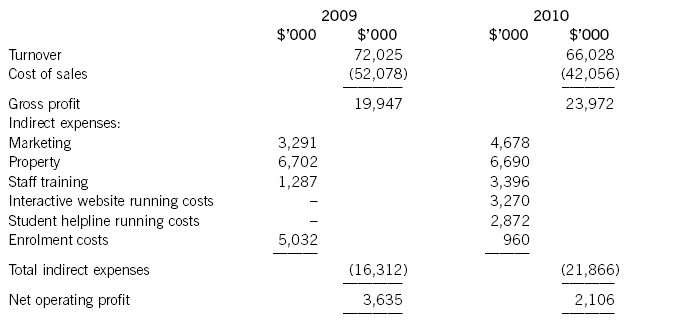

The Accountancy Teaching Co (AT Co) is a company specialising in the provision of accountancy tuition courses in the private sector. It makes up its accounts to 30 November each year. In the year ending 30 November 2009, it held 60% of market share. However, over the last twelve months, the accountancy tuition market in general has faced a 20% decline in demand for accountancy training leading to smaller class sizes on courses. In 2009 and before, AT Co suffered from an ongoing problem with staff retention, which had a knock-on effect on the quality of service provided to students. Following the completion of developments that have been ongoing for some time, in 2010 the company was able to offer a far-improved service to students. The developments included:– A new dedicated 24 hour student helpline– An interactive website providing instant support to students– A new training programme for staff– An electronic student enrolment system– An electronic marking system for the marking of students’ progress tests. The costs of marking electronically were expected to be $4 million less in 2010 than marking on paper. Marking expenditure is always included in cost of salesExtracts from the management accounts for 2009 and 2010 are shown below:

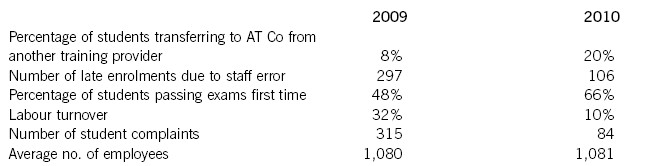

On 1 December 2009, management asked all ‘freelance lecturers’ to reduce their fees by at least 10% with immediate effect (‘freelance lecturers’ are not employees of the company but are used to teach students when there are not enough of AT Co’s own lecturers to meet tuition needs). All employees were also told that they would not receive a pay rise for at least one year. Total lecture staff costs (including freelance lecturers) were $41·663 million in 2009 and were included in cost of sales, as is always the case. Freelance lecturer costs represented 35% of these totallecture staff costs. In 2010 freelance lecture costs were $12·394 million. No reduction was made to course prices in the year and the mix of trainees studying for the different qualifications remained the same. The same type and number of courses were run in both 2009 and 2010 and the percentage of these courses that was run by freelance lecturers as opposed to employed staff also remained the same.Due to the nature of the business, non-financial performance indicators are also used to assess performance, as detailed below.

On 1 December 2009, management asked all ‘freelance lecturers’ to reduce their fees by at least 10% with immediate effect (‘freelance lecturers’ are not employees of the company but are used to teach students when there are not enough of AT Co’s own lecturers to meet tuition needs). All employees were also told that they would not receive a pay rise for at least one year. Total lecture staff costs (including freelance lecturers) were $41·663 million in 2009 and were included in cost of sales, as is always the case. Freelance lecturer costs represented 35% of these totallecture staff costs. In 2010 freelance lecture costs were $12·394 million. No reduction was made to course prices in the year and the mix of trainees studying for the different qualifications remained the same. The same type and number of courses were run in both 2009 and 2010 and the percentage of these courses that was run by freelance lecturers as opposed to employed staff also remained the same.Due to the nature of the business, non-financial performance indicators are also used to assess performance, as detailed below.

Required:Assess the performance of the business in 2010 using both financial performance indicators calculated from the above information AND the non-financial performance indicators provided.

Required:Assess the performance of the business in 2010 using both financial performance indicators calculated from the above information AND the non-financial performance indicators provided.

参考答案:TurnoverTurnover has decreased from $GB·0BE million in B00I to $FF·0BH million in B0A0, a fall of H·C%. However, this must be assessed by taking into account the change in market conditions, since there has been a B0% decline in demand for accountancy training. Given this B0% decline in the market place, AT Co’s turnover would have been expected to fall to $EG·FBm if it had kept in line with market conditions. Comparing AT Co’s actual turnover to this, it’s actual turnover is AD·F% higher than expected. As such, AT Co has performed fairly well, given market conditions.It can also be seen from the non-financial performance indicators that B0% of students in B0A0 are students who have transferred over from alternative training providers. It is likely that they have transferred over because they have heard about the improved service that AT Co is providing. Hence, they are most likely the reason for the increased market share that AT Co has managed to secure in B0A0.Cost of salesCost of sales has decreased by AI·B% in B0A0. This must be considered in relation to the decrease in turnover as well. In B00I, cost of sales represented GB·C% of turnover and in B0A0 this figure was FC·G%. This is quite a substantial decrease. The reasons for it can be ascertained by, firstly, looking at the freelance staff costs.In B00I, the freelance costs were $AD·EHBm. Given that a minimum A0% reduction in fees had been requested to freelance lecturers and the number of courses run by them was the same year on year, the expected cost for freelance lecturers in B0A0 was $AC·ABDm. The actual costs were $AB·CIDm. These show that a fee reduction of AE% was actually achieved. This can be seen as a successful reduction in costs.The expected cost of sales for B0A0 before any cost cuts, was $DG·GCHm assuming a consistent ratio of cost of sales to turnover. The actual cost of sales was only $DB·0EFm, $E·FHBm lower. Since freelance lecturer costs fell by $B·AHHm, this means that other costs of sale fell by the remaining $C·DIDm. Staff costs are a substantial amount of this balance but since there was a pay freeze and the average number of employees hardly changed from year to year, the decreased costs are unlikely to be related to staff costs. The decrease is therefore most probably attributable to the introduction of online marking. AT Co expected the online marking system to cut costs by $Dm, but it is probable that the online marking did not save as much as possible, hence the $C·DIDm fall. Alternatively, the saved marking costs may have been partially counteracted by an increase in some other cost included in cost of sales.Gross profitAs a result of the above, the gross profit margin has increased in B0A0 from BG·G% to CF·C%. This is a big increase and reflects very well on management.Indirect expenses– Marketing costs: These have increased by DB·A% in B0A0. Although this is quite significant, given all the improvements that AT Co has made to the service it is providing, it is very important that potential students are made aware of exactly what the company now offers. The increase in marketing costs has been rewarded with higher student numbers relative to the competition in B0A0 and these will hopefully continue increasing next year, since many of the benefits of marketing won’t be felt until the next year anyway. The increase should therefore be viewed as essential expenditure rather than a cost that needsto be reduced.– Property costs: These have largely stayed the same in both years.– Staff training: These costs have increased dramatically by over $B million, a AFC·I% increase. However, AT Co had identified that it had a problem with staff retention, which was leading to a lower quality service being provided to students. Also, due to the introduction of the interactive website, the electronic enrolment system and the online marking system, staff would have needed training on these areas. If AT Co had not spent this money on essential training, the quality of service would have deteriorated further and more staff would have left as they became increasingly dissatisfied with their jobs. Again, therefore, this should be seen as essential expenditure.Given that the number of student complaints has fallen dramatically in B0A0 to HD from CAE, the staff training appears to have improved the quality of service being provided to students.– Interactive website and the student helpline: These costs are all new this year and result from an attempt to improve the quality of service being provided and, presumably, improve pass rates. Therefore, given the increase in the pass rate for first time passes from DH% to FF% it can be said that these developments have probably contributed to this. Also, they have probably played a part in attracting new students, hence improving turnover.– Enrolment costs have fallen dramatically by H0·I%. This huge reduction is a result of the new electronic system being introduced. This system can certainly be seen as a success, as not only has it dramatically reduced costs but it has also reduced the number of late enrolments from BIG to A0F.Net operating profitThis has fallen from $C·FCEm to $B·A0Fm. On the face of it, this looks disappointing but it has to be remembered that AT Co has been operating in a difficult market in B0A0. It could easily have been looking at a large loss. Going forward, staff training costs will hopefully decrease. Also, market share may increase further as word of mouth spreads about improved results and service at AT Co. This may, in turn, lead to a need for less advertising and therefore lower marketing costs.It is also apparent that AT Co has provided the student website free of charge when really, it should have been charging a fee for this. The costs of running it are too high for the service to be provided free of charge and this has had a negative impact on net operating profit.Note: Students would not have been expected to write all this in the time available.Workings (Note: All workings are in $’000)A. Turnover Decrease in turnover = $GB,0BE – $FF,0BH/$GB,0BE = H·C% Expected B0A0 turnover given B0% decline in market = $GB,0BE x H0% = $EG,FB0 Actual B0A0 turnover CF expected = $FF,0BH – $EG,FB0/$EG,FB0 = AD·F% higherB. Cost of sales Decrease in cost of sales = $DB,0EF – $EB,0GH/$EB,0GH = AI·B% Cost of sales as percentage of turnover: B00I = $EB,0GH/$GB,0BE = GB·C% B0A0 = $DB,0EF/$FF,0BH = FC·G% Freelance staff costs: in B00I = $DA,FFC x CE% = $AD,EHB Expected cost for B0A0 = $AD,EHB x I0% = $AC,ABD Actual B0A0 cost = $AB,CID $AB,CID – $AD,EHB = $B,AHH decrease $B,AHH/$AD,EHB = AE% decrease in freelancer costs Expected cost of sales for B0A0, before costs cuts, = $FF,0BH x GB·C% = $DG,GCH. Actual cost of sales = $DB,0EF. Difference = $E,FHB, of which $B,AHH relates to freelancer savings and $C,DID relates to other savings.C. Gross profit margin B00I: $AI,IDG/$GB,0BE = BG·G% B0A0: $BC,IGB/$FF,0BH = CF·C%D. Increase in marketing costs = $D,FGH – $C,BIA/$C,BIA = DB·A%E. Increase in staff training costs = $C,CIF – $A,BHG/$A,BHG = AFC·I%F. Decrease in enrolment costs = $IF0 – E,0CB/E,0CB = H0·I%G. Net operating profit Decreased from $C,FCE to $B,A0F. This is fall of A,EBI/C,FCE = DB·A%