Helena, Nikita, Rosa and Yuri are four partners working in an unlimited partnership that provides training courses. heir partnership agreement states that each partner may act on behalf of the partnership in respect of deals with hird parties, but requires any transaction valued in excess of 500.000 roubles to be sanctioned by all partners. The greement further specifi es that any partner’s resignation will be subject to a notice period of three months, thereby nabling the business to fulfi l outstanding course bookings.Without consulting the other partners, Rosa withdrew 700.000 roubles from the partnership bank account in order o purchase a training software package from OOO Train, a regular supplier to the partnership. Rosa also admitted to sing the partnership premises and teaching resources on a private basis in order to increase her personal income. She efused to provide details but offered to make a payment of 100.000 roubles in respect of this privately commissioned usiness.In a subsequent argument between the partners, Yuri walked out of the business, stating that he would no longer be ble to work with the other partners, refusing to carry out any further commitments with immediate effect.Required:

(b) Explain whether OOO Train has an obligation to accept a return of the training software package and refund he partnership with the price paid. (3 marks)

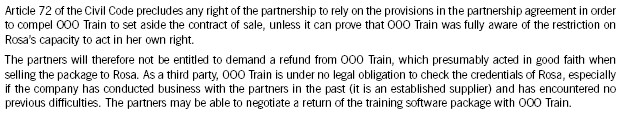

参考答案: