Lorna is a final year art student at the National College of Art and Design. Since September 2006 Lorna would, from time to time, make various pieces of jewellery as gifts for her friends and sometimes they would ask her to make a specific piece. Her friends would then pay her for the piece, the amount paid was usually decided upon by her friends and not Lorna.Since September 2008 Lorna has begun to increase her range and sales of jewellery. She continues to sell through a network of friends and relations. Lorna also recently purchased a small stock of beads, stones, glass and other materials. She now prices the item, herself, rather than leaving it up to the individual to set the price.Recently Lorna’s brother who is a trainee accountant has told her that she may have an income tax liability arising from the sale of the jewellery. Lorna is concerned at this as she believed this was her hobby.Required:

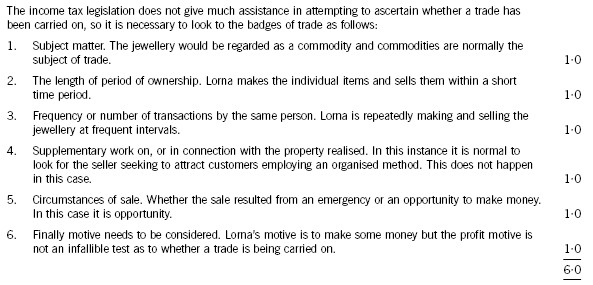

(a) Briefly explain the factors that would be considered in deciding whether or not Lorna is carrying on a trade. (6 marks)

参考答案: