ABC公司是一零售业上市公司,请你协助完成2003年的盈利预测工作,上年度的财务报表如下:

利润表

2002年 单位:万元

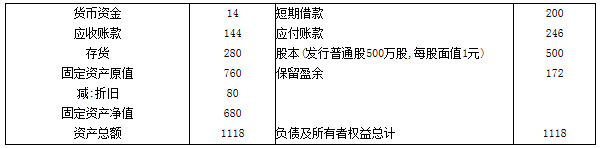

资产负债表

2002年12月31日 单位:万元

其他财务信息如下:

(1) 下一年度的销售收入预计为1512万元;

(2) 预计毛利率上升5个百分点;

(3) 预计经营和管理费的变动部分与销售收入的百分比不变;

(4) 预计经营和管理费的固定部分增加20万元;

(5) 购置固定资产支出220万元,并因此使公司年折旧额达到30万元;

(6) 应收账款周转率(按年末余额计算)预计不变,上年应收账款均可在下年收回;

(7) 年末应付账款余额与当年进货金额的比率不变;

(8) 期末存货金额不变;

(9) 现金短缺时,用短期借款补充,借款的利息率(按期末借款金额计算)不变,借款必须是5万元的倍数;假设新增借款需年初借人,所有借款全年计息,本金年末不归还;年末现金余额不少于10万;

(10) 预计所得税为30万元;

(11) 假设年度内现金流动是均衡的,无季节性变化。

要求:

(1) 确定下年度现金流人、现金流出和新增借款数额;

(2) 预测下年度税后利润;

(3) 预测下年度每股盈利。

参考答案:

(1) 确定借款数额和利息 现金流人:

应收账款周转率=1260÷144=8.75(次)

期末应收账款=1512÷8.75=172.8(万元)

现金流人=1512-(172.8-144)=1483.2(万元)

现金流出:年末应付账款=1512×(80%-5%)×246÷1008=276.75(万元)

购货支出=1512×75%-(276.75-246)=1103.25(万元)

费用支出=1512×63÷1260+(63+20)=158.6(万元)

购置固定资产支出:220(万元)

预计所得税:30(万元)

现金流出合计 1511.85(万元)

现金多余或不足 -14.65(万元)即(14+1483.2-1511.85)

加:新增借款的数额 40(万元)

减:利息支出 12(万元)即[10÷200×(200+40)] 期末现金余额 13.35(万元)

(2) 预计税后利润 收入 1512(万元) 减:销货成本 1134(万元)即[1512×(80%-5%)] 毛利 378(万元) 减:经营和管理费: 变动费用 75.6(万元)即(1512×63÷1260) 固定费用 83(万元)即(63+20) 折旧 30(万元)

营业利润 189.4(万元) 减:利息 12(万元) 利润总额 177.4(万元) 减:所得税 30(万元) 税后利润 147.4(万元)

(3) 预计每股盈余=147.4÷500=0.29(元/股)

解析:

本题的主要考核点是现金预算的编制和预计利润表个别项目的计算。本题主要考核现金预算表和盈利预测的编制。题中首先给出了ABC公司上年度的利润表和资产负债表以及有关的预测信息,要求确定下年度的现金流量及新增借款额并预测下年度税后利润和每股盈利。从本题给出的资料及要求看,要想计算出下年度新增借款额,应首先预计现金流入量和现金流出量,进而计算出现金的多余或不足额,然后再分析解决其他问题。 要熟悉现金流量表直接法下有关销售商品提供劳务的现金流人量和购买商品接受劳务现金流出量的计算原理(本题为商业企业,所以知道商业企业现金流量表的简单编制原理就足够了,工业企业现金流量表的编制稍微复杂一些,故不考虑增值税、预收账款、预付账款和其他业务收入等其他问题): (1) 销售商品收到的现金=现销收入=全部收入-赊销收入 注意:赊销收入=[(应收账款期末余额-应收账款期初余额)+(应收票据期末余额-应收票据期初余额)] 具体计算公式如下: 销售商品、提供劳务收到的现金=主营业务收入-[(应收账款期末余额-应收账款期初余额)+(应收票据期末余额-应收票据期初余额)] 本题中预计的销售收入为1512万元,减去本期应收账款期末余额172.8万元(根据应收账款的周转率就可以计算出期末应收账款余额)与期初余额144万元的差额后,即为本期的现金流人额1483.2万元。 (2)期初存货+本期购货=本期销货+期末存货 即:本期购货=本期销货+期末存货-期初存货 本期购货付现=本期购货-本期赊购=(本期销货+期末存货-期初存货)-本期赊购 注意:本期赊购=[(应付账款期末余额-应付账款期初余额)+(应付票据期末余额-应付票据期初余额)] 具体计算公式如下: 购买商品、接受劳务支付的现金=主营业务成本+(存货期末余额-存货期初余额)- [(应付账款期末余额-应付账款期初余额)+(应付票据期末余额-应付票据期初余额)] 由于本题中期末存货和期初存货金额不变,所以,上式中期末存货-期初存货=0;又由于企业的销售毛利率上升5%,也就是说销货成本率将下降5%,即下降到75%(原来为 1008÷1260=80%),进而知道本期销货成本为1134万元(1512×75%),减去本期应付账款期末余额276.75万元(根据题中“年末应付账款余额与当年进货金额的比率不变”这一条件,就可以计算出本期应付账款期末余额=246÷1008×1512×(80%-5%)= 276.75万元)与期初余额246万元的差额后,即为本期购货的现金流出额1103.25万元。这样就容易计算出未扣除借款利息(因尚未确定新增借款额,所以不能计算借款利息总额)的现金不足额为14.65万元。由于年末现金余额不少于10万元,至少需借款24.65万元(14.65+10),同时又需偿付原有利息10万元,这样计算出至少应借款34.65万元 (24.65+10),进一步考虑新增债务利息,同时借款又必须是5万元的倍数,所以得出借款应是40万元。在确定了新增借款以后,计算税后利润与每股盈利都是比较容易的。