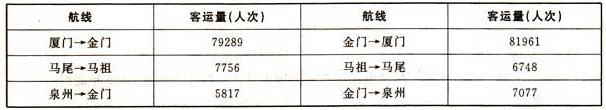

二、根据以下资料,回答106—110题。 2008年1至3月份,福建沿海地区与台湾地区海上客运直航船舶的公司共运营2425航次,共运送旅客188648人次,分别为2007年同期的108%、97%;其中,大陆5家船舶公司经营的7艘客船共运营1190航次,运送旅客96017人次,台湾6家船舶公司经营的8艘客船共运营1235航次,运送旅客92631人次。大陆船舶公司和台湾船舶公司客运量比例为51∶49。具体流向、流量情况如下:

2010年1至3月份,福建沿海地区与台湾地区海上客运直航船舶公司共运营3448航次,共运送旅客312119人次,分别比上年同期增加了11.98%,-4.58%,其中厦门金门航线客运量272951人次,比上年同期减少了2.38%;马尾马祖航线客运量16077人次,比上年同期减少了38.45%;泉州金门航线客运量23091人次,比上年同期增加了12.59%。具体流向、流量情况如下:

“小三通”客运自2001年开通以来,共运载旅客5419061人次,其中厦门金门航线4825431人次,马尾马祖航线351228人次,泉州金门航线235918人次,湄洲金门航线1346人次,湄洲马祖航线491人次,马祖宁德航线321人次,厦门澎湖航线4056人次。

从以上资料可以推断出的是()。

A.2008年,厦门金门、马尾马祖和泉州金门三航线中客运量流向逆差最高的是厦门金门航线

B.2008年,厦门金门、马尾马祖和泉州金门三航线中客运量流向逆差最高的是泉州金门航线

C.2008至2010年,厦门金门、马尾马祖和泉州金门三航线中客运量同期增长最快的是马尾马祖航线

D.2008至2010年,厦门金门、马尾马祖和泉州金门三航线中客运量同期增长最快的是厦门金门航线

参考答案:A

解析:

本题属于综合推断题。由第一个表格可知,厦门金门流向逆差约为2600人次,马尾马祖为顺差,泉州金门约为1200人次,A正确、B错误。 由第一、二个表格可知,厦门金门增速为[(135791+137160)/(79289+81961-1)]×100%≈(273/161-1)×100%≈69%; 马尾马祖航线客运量增速为[(8736+7341)/(7756+6748-1)]×100%≈(161/145-1)×100%≈11%; 泉州金门航线客运量增速为[(10948+12143)/(5817+7077-1)]×100%≈(231/129-1)×100%≈79%。因此C、D都错误。