问题

单项选择题

四、根据下列资料。

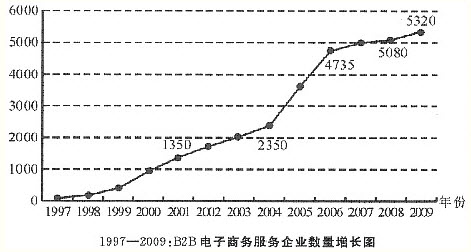

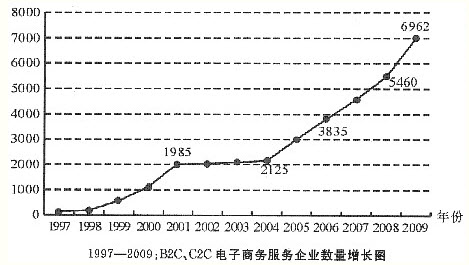

据中国B2B研究中心相关调查数据显示,截止到2009年6月,我国规模以上电子商务网站总量已经达12282家。其中,B2B电子商务服务企业有5320家B2C、C22C与其他非主流模式企业达6962家,特别是自进入2008年来,呈现出高速增长、乃至井喷之势。

目前国内电子商务服务企业主要分布在长三角、珠三角一带以及北京等经济较为发达的省市。其中长三角占有33.52%的份额,珠三角占有32.04%,北京占有8.86%,国内其他地方共占有25.58%。

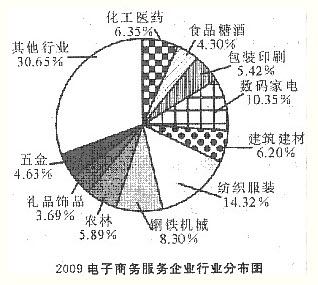

另在电子商务服务企业的行业分布中,据中国B2B研究中心调查显示,排在前十名的依次为:纺织服装、数码家电、钢铁机械、化工医药、建筑建材、农林、五金、包装印刷、食品糖酒、礼品饰品这些行业领域。

2004年到2009年间,B2C、C2C电子商务服务企业数量高于B2B电子商务服务企业数量i的年度共有()个。

A.1

B.2

C.3

D.4

答案

参考答案:B

解析:

由两幅折线图可以看出,从2004年至2009年,B2C、C2C电子商务服务企业数量高于B2B电子商务服务企业数量的年度是2008年、2009年,共2年。故本题答案为B。