(a)Five friends Dennis, James, Kelvin, Peter and Sylvester, who are all qualified chemists, decide to launch a pharmaceutical company called Ponesai Vanhu Ltd. The company has an authorised share capital of 1,000,000 shares divided into 1,000,000 shares of $1 each. Prior to the company launching a public share offer (IPO) for purposes of raising some of the company’s much needed capital the five promoters who are all directors of the company issued a prospectus in accordance with the requirements of the Companies Act (Chapter 24:03).The prospectus among many other statements makes the following declarations under the heading, ‘The Company’s Trading Prospects’1. That the company had already secured lines of credit from a reputable overseas bank for purposes of securing state of the art plant and equipment for manufacturing drugs.2. That the company had secured export orders from customers in three neighbouring countries.It turns out that discussions with the overseas bank and potential customers from the three neighbouring countries are still on-going and are unlikely to be concluded satisfactorily any time soon. When this information comes to light the company’s shares, which had started trading at $10·00 each are now worth only 20 cents.Two shareholders, Innocent and Ndapusa decide to sue the company’s five directors for misrepresentation.Required:In relation to company law, describe Innocent and Ndapusa’s prospects of success in their intended litigation against the company’s promoters. (5 marks)

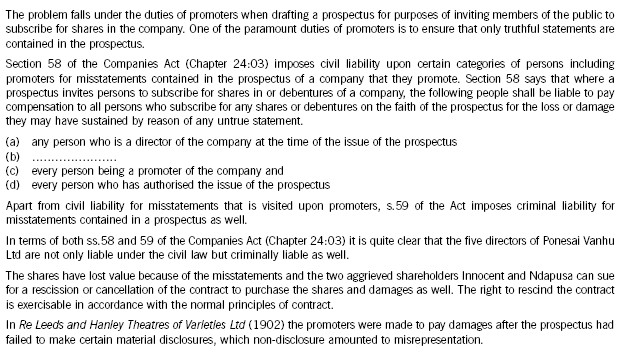

参考答案: