问题

问答题

(b)Company B is a resident enterprise, which was incorporated in the year 1990. The table below shows the taxable profits of Company B, as agreed by the tax bureau, for the years 2002 to 2009 inclusive.

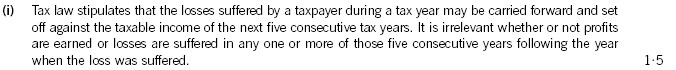

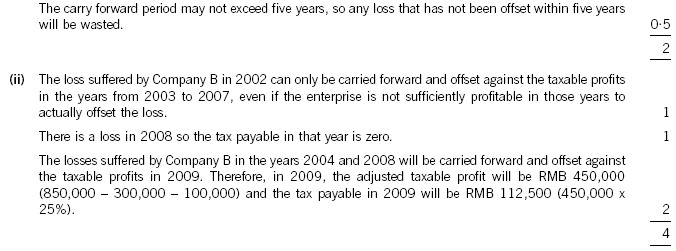

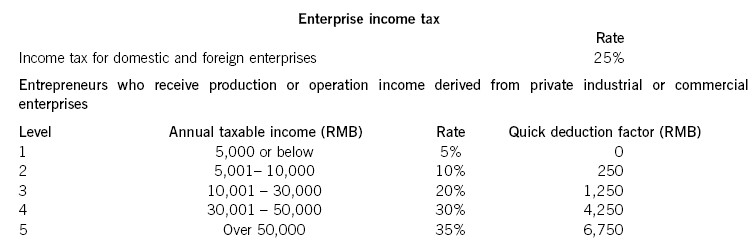

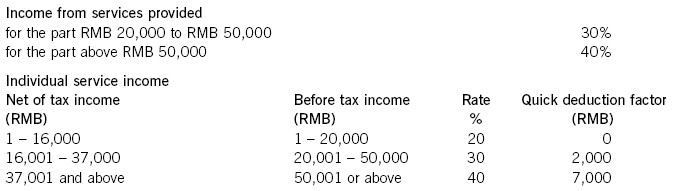

Required:(i) Briefly explain the tax treatment of losses, including the period for the offset of losses; (2 marks)(ii) State, giving reasons, how much enterprise income tax (EIT) will be payable by Company B for each of the years 2008 and 2009. (4 marks)

Required:(i) Briefly explain the tax treatment of losses, including the period for the offset of losses; (2 marks)(ii) State, giving reasons, how much enterprise income tax (EIT) will be payable by Company B for each of the years 2008 and 2009. (4 marks)

答案

参考答案: