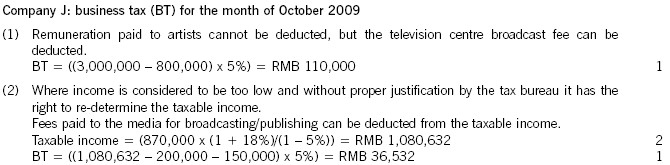

(b) Company J, an advertising company, had the following transactions in the month of October 2009:(1) Earned RMB 3,000,000 from a cosmetic company. The artists in the advertisement were paid RMB 1,000,000 and the television centre broadcast fee was RMB 800,000.(2) Earned RMB 870,000 from a pharmaceutical company. The cost of the advertisement was RMB 800,000, the television centre broadcast fee was RMB 200,000 and the newspaper offices publishing fee was RMB 150,000. The income assessed was considered to be too low and without proper justification by the tax bureau, which determined the taxable income should be re-calculated at a deemed profit rate of 18% on the reported earnings.(3) Received RMB 1,200,000 from a wine shop for making an advertising banner outside a building. Company J purchased materials for RMB 700,000 for which a general sales invoice was obtained. The banner was sewn in Company J’s sample room at a labour cost of RMB 20,000 and installed by its property management department for a cost of RMB 30,000.(4) Invested RMB 1,500,000 in immovable property and assigned intangible assets worth RMB 300,000 to a certain enterprise as a capital contribution.(5) Earned RMB 200,000 by holding a fashion show.(6) Received RMB 500,000 from the transfer of the patent on a certain advertisement design.Required:Briefly explain and calculate the business tax (BT) payable by Company J for the month of October 2009. (8 marks)

参考答案: